The best way to optimise your transaction data.

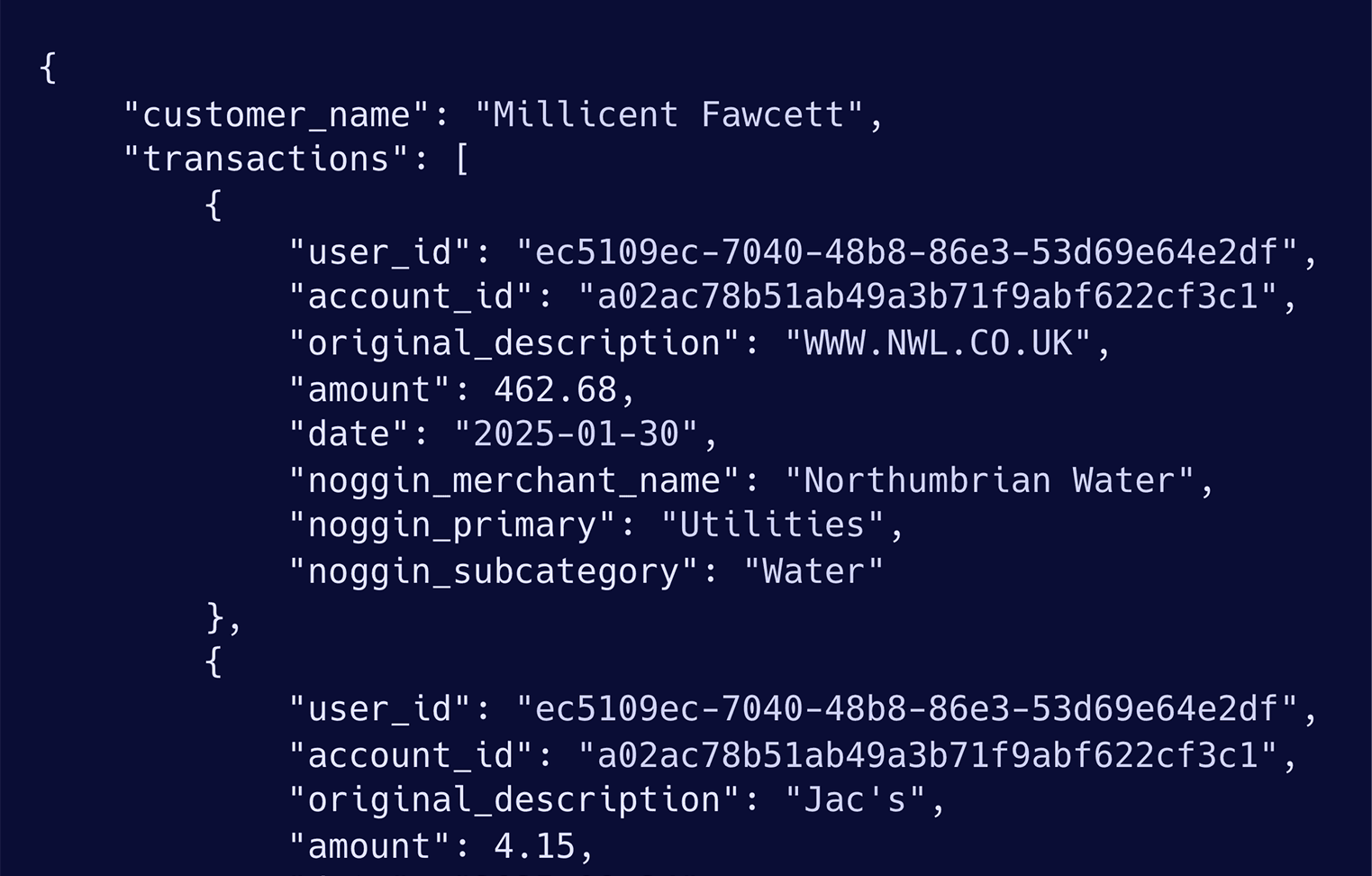

Noggin uses AI to remove noise and enrich transaction data, for use in apps, decisioning, and analysis.

Supported & trusted by:

“Labelling is the hardest problem in Open Banking. Having tried a number of commercially available automated solutions, Noggin stands out as faster, more accurate and reliable, particularly for consumer bank accounts”

Charles Cohen, CEO, Department of Trust

World-class categorisation.

Trained on gold-standard human annotation, Noggin’s categorisation offers ~23% accuracy improvement against market leaders.

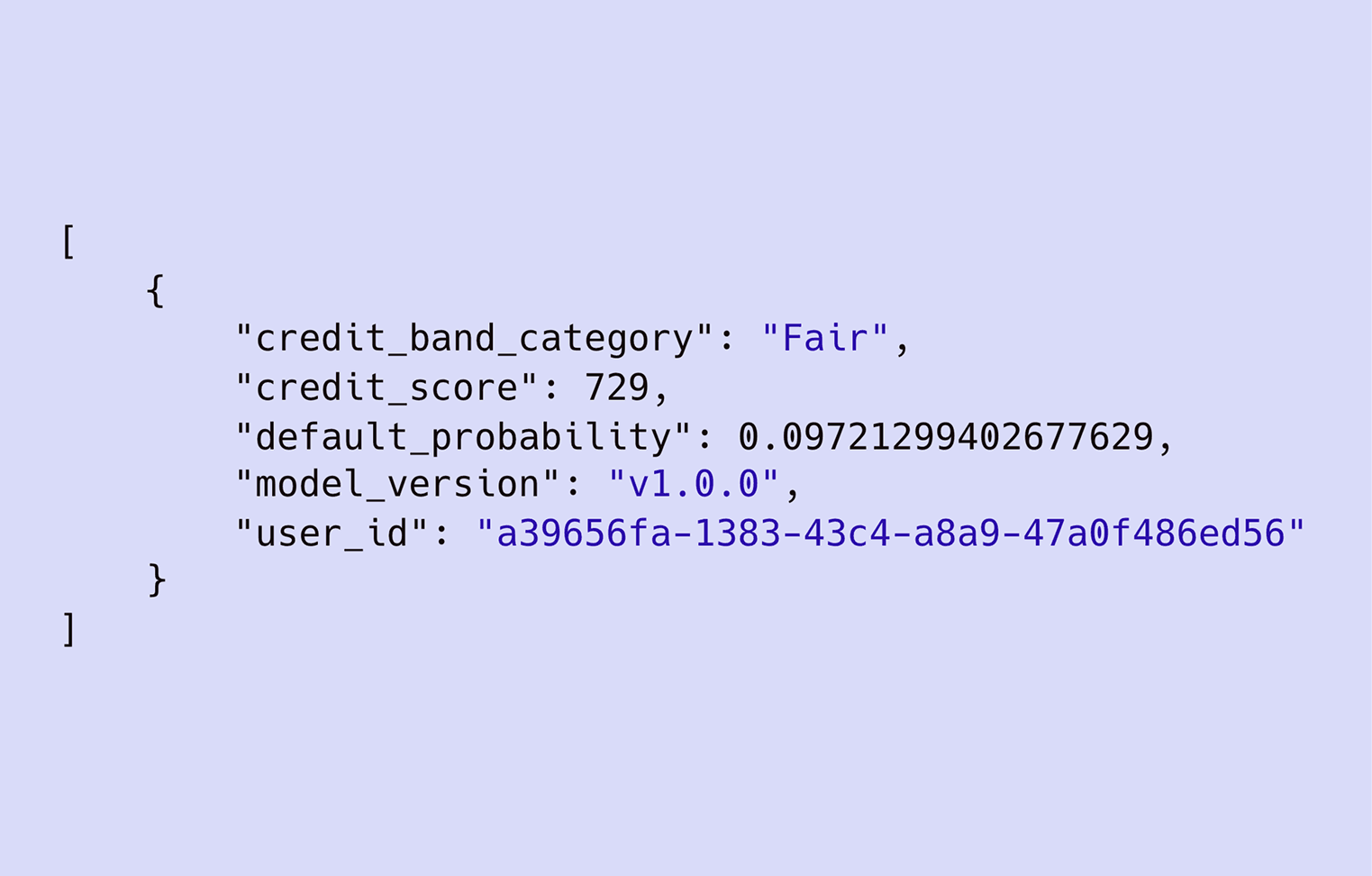

Real-time credit score.

We look at behavioural patterns in transaction data to predict the future default status of consumers applying for credit.

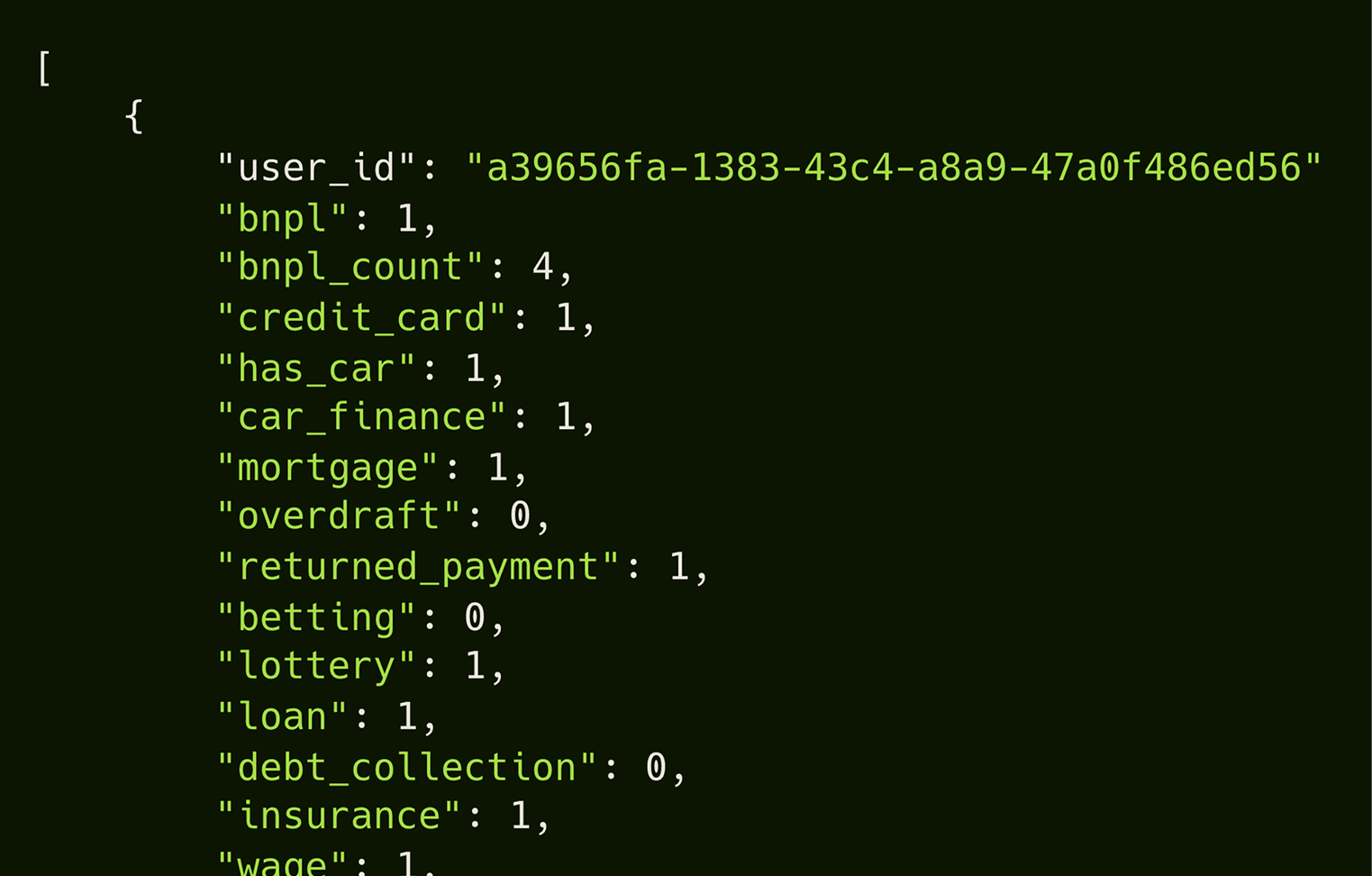

Bespoke enrichments.

We look at the last 30-days in an individual’s spending to highlight new borrowing, rent payments, income, trends and changes.

Who do we serve?

Financial health apps

Credit unions

Unsecured Personal Loan providers

Credit card providers

TELCO

Mortgage providers

Change is coming to the financial services industry, join the forward-thinking companies who’re getting ahead.

We make Open Banking data work for you.

© 2026 Noggin HQ Ltd. All rights reserved.

Noggin HQ Ltd is authorised and regulated by the Financial Conduct Authority (FRN: 993735).

We make Open Banking data work for you.

© 2026 Noggin HQ Ltd. All rights reserved.

Noggin HQ Ltd is authorised and regulated by the Financial Conduct Authority (FRN: 993735).

We make Open Banking data work for you.

© 2026 Noggin HQ Ltd. All rights reserved.

Noggin HQ Ltd is authorised and regulated by the Financial Conduct Authority (FRN: 993735).